Authorized Entity GOLDCO

A special Chuck Norris silver coin is offered for sale with Goldco. At present, Goldco is listed 3,774 in the Inc. Should you have almost any issues concerning exactly where and also tips on how to utilize news, you can e mail us on our own site. 500 list of the top American companies. Compensation might impact the place & how corporations appear on the site. To keep up our free service for consumers, LendEDU sometimes receives compensation when readers click on to, apply for, or buy products featured on the site. According to IRS guidelines, you'll be able to only buy metals of a sure purity with an IRA.

Despite having higher account minimums than some opponents ($25,000), Goldco supplies many exclusive advantages that others should not have; as an illustration, it’s simple to transfer any kind of retirement accounts like IRAs or 401(k), 403(b), in addition to TSP accounts-not just financial savings accounts. Gold and silver IRAs are Goldco’s bread and butter. Some of these coins are limited circulation because they're part of a collectible collection issued by certain mints. Prior to making any decisions, it’s mandatory to grasp the primary difference between these two varieties of coins.

Despite having higher account minimums than some opponents ($25,000), Goldco supplies many exclusive advantages that others should not have; as an illustration, it’s simple to transfer any kind of retirement accounts like IRAs or 401(k), 403(b), in addition to TSP accounts-not just financial savings accounts. Gold and silver IRAs are Goldco’s bread and butter. Some of these coins are limited circulation because they're part of a collectible collection issued by certain mints. Prior to making any decisions, it’s mandatory to grasp the primary difference between these two varieties of coins.

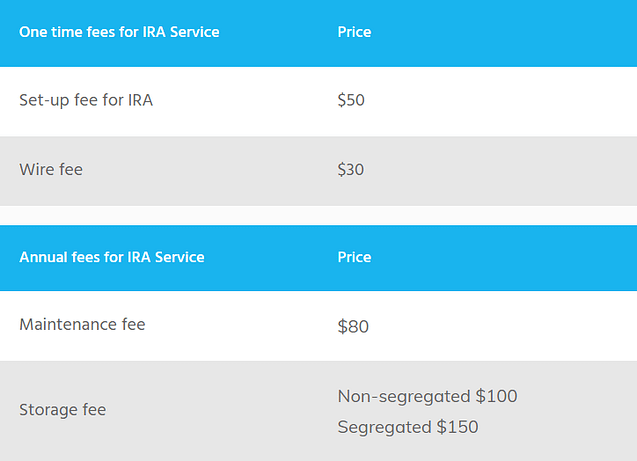

This free guide will clarify the whole lot you'll want to know earlier than making any choice on what types of metals you want to place in your IRA. There isn't a want to worry because Goldco will help you in transferring any gold or silver bullion that you simply purchase over to a secured vault. Before REQUESTING THIS FREE PDF Information. You can get started by signing up on Goldco’s webpage or requesting a free informational equipment. The Taxpayer Relief Act of 1997 made exceptions to the IRS collectibles rule, permitting specific coins of a sure fineness and high quality stage for IRA investments. The custodian will normally tell you ways so much cash you’re allowed to spend in a yr when you open your account, but when not, the IRS web site offers all the main points you want. Though you possibly can technically withdraw funds from your gold IRA at any time, you will owe a 10% penalty if doing so earlier than age 59.5. After you hit 59.5, withdrawals are tax-free. If you put the wrong kind of coin into your IRA, you could also be charged as if the funding were an early withdrawal: this means a 10% penalty plus income tax for each year that the error lasts. To make certain you’re steering clear of these scams, as well as getting the most effective service and investment guidance, it’s vital to compare your options completely.

This free guide will clarify the whole lot you'll want to know earlier than making any choice on what types of metals you want to place in your IRA. There isn't a want to worry because Goldco will help you in transferring any gold or silver bullion that you simply purchase over to a secured vault. Before REQUESTING THIS FREE PDF Information. You can get started by signing up on Goldco’s webpage or requesting a free informational equipment. The Taxpayer Relief Act of 1997 made exceptions to the IRS collectibles rule, permitting specific coins of a sure fineness and high quality stage for IRA investments. The custodian will normally tell you ways so much cash you’re allowed to spend in a yr when you open your account, but when not, the IRS web site offers all the main points you want. Though you possibly can technically withdraw funds from your gold IRA at any time, you will owe a 10% penalty if doing so earlier than age 59.5. After you hit 59.5, withdrawals are tax-free. If you put the wrong kind of coin into your IRA, you could also be charged as if the funding were an early withdrawal: this means a 10% penalty plus income tax for each year that the error lasts. To make certain you’re steering clear of these scams, as well as getting the most effective service and investment guidance, it’s vital to compare your options completely.

Goldco Precious Metals provides gold and silver IRAs as its main service. Moreover, buyers can legally hold and store gold and silver exterior of the financial system or banking system, which decreases governmental management. Fortuitously, Goldco Precious Metals offers investors a large number of coins and bars that adhere to the above purity standards and IRA rules. We also present a wealth property that empower traders to make educated decisions within the valuable metals sector. Goldco offers various IRS-accepted silver and gold coins, and its investing specialists can aid you make the best purchases on your goals. This mediocre rating is closely influenced by one unfavourable evaluate that reveals up on two websites (Sitejabber and Yelp). Moreover, two more choices are Brinks in Salt Lake City and IDS in Dallas, Texas. In the event you favored this article and you want to receive much more particulars regarding goldco chuck norris kindly try our personal website. As with any firm, Goldco has its execs and cons.

Reviews