Personal Loans For Bad Credit Monthly Payments - Mojeek Search

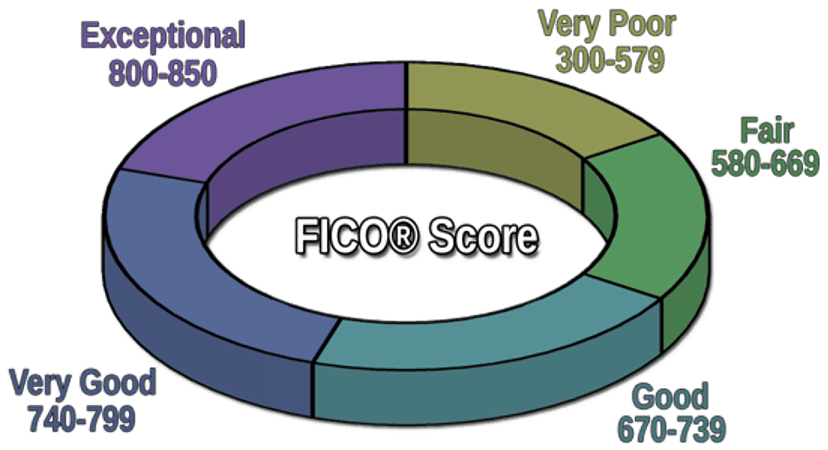

AimFinance presents loans to those with fair and even bad credit. It is normally finest to keep away from these loans, but if you're out of monetary choices, a no-credit score-test loan could make it easier to make ends meet. No-credit score-test loans usually cost 400% or extra in curiosity. One of the largest benefits of personal loans for bad credit is that they often include way more favorable curiosity rates than traditional loans. Bad credit loans are personal loans that are available to borrowers with a low credit score rating, typically around 580 to 620. Lenders who offer bad credit loans know that an applicant’s credit rating shouldn't be the only manner to find out if someone is willing and able to repay a loan, and can usually consider alternative knowledge as effectively. A bad credit loan is a personal installment loan. GreenLightCash is the most effective places to get a personal loan for bad credit. So if you’re looking for quick loans inside Ontario, we’re here to assist!

AimFinance presents loans to those with fair and even bad credit. It is normally finest to keep away from these loans, but if you're out of monetary choices, a no-credit score-test loan could make it easier to make ends meet. No-credit score-test loans usually cost 400% or extra in curiosity. One of the largest benefits of personal loans for bad credit is that they often include way more favorable curiosity rates than traditional loans. Bad credit loans are personal loans that are available to borrowers with a low credit score rating, typically around 580 to 620. Lenders who offer bad credit loans know that an applicant’s credit rating shouldn't be the only manner to find out if someone is willing and able to repay a loan, and can usually consider alternative knowledge as effectively. A bad credit loan is a personal installment loan. GreenLightCash is the most effective places to get a personal loan for bad credit. So if you’re looking for quick loans inside Ontario, we’re here to assist!

In case you are on the lookout for Ontario bad credit loans or one thing comparable, AimFinance loans are straightforward to apply for with quick decisions and the funds are deposited as quickly as the next day if approved. Payday loan shops are physical locations where you may go to use and choose up authorised loan funds. This company is among a handful of lenders on this record that provide funds up to $100,000, and offers loan phrases as much as 12 to 84 months. Then, you’ll have 30 days or six weeks to repay what you borrowed (or up to 24 months if you utilize Klarna Financing). Loans function repayment terms of 24 to 84 months. No credit examine loans and assured approval loans typically have short repayment phrases. As opposed to conventional lenders who will usually conduct a comprehensive credit verify for an online loan, no credit score check loan and bad credit loan lenders primarily assess a borrower’s present capability to repay the loan. Lenders of bad credit loans typically have higher interest rates loans since these loans come with dangers to the lender when most applying have fair to bad credit scores.

Sure information that LendingClub Financial institution subsequently obtains as part of the applying process (including but not restricted to info in your client report, your earnings, the loan quantity that you request, the purpose of your loan, and qualifying debt) might be thought of and could have an effect on your ability to acquire a loan. So no have to be embarrassed in asking money from your mates and relations, merely have to do is to fill up a simple software for dwelling improvement. If you loved this write-up and you would certainly such as to obtain even more details regarding personal loans for bad credit monthly payments kindly visit the web site. What Information Will Lenders Verify? Many on-line lenders provide varied forms of loans including bad credit loans, personal loans, payday loans, and Personal Loans For Bad Credit Monthly Payments no credit score verify loans, usually with fast approval and disbursement. What distinguishes them from different types of loans is that there’s no laborious inquiry involved, making it doable for individuals with bad credit scores, personal loans for bad credit monthly payments and even no credit score historical past in any respect, to get accredited for emergency funding.

Sure information that LendingClub Financial institution subsequently obtains as part of the applying process (including but not restricted to info in your client report, your earnings, the loan quantity that you request, the purpose of your loan, and qualifying debt) might be thought of and could have an effect on your ability to acquire a loan. So no have to be embarrassed in asking money from your mates and relations, merely have to do is to fill up a simple software for dwelling improvement. If you loved this write-up and you would certainly such as to obtain even more details regarding personal loans for bad credit monthly payments kindly visit the web site. What Information Will Lenders Verify? Many on-line lenders provide varied forms of loans including bad credit loans, personal loans, payday loans, and Personal Loans For Bad Credit Monthly Payments no credit score verify loans, usually with fast approval and disbursement. What distinguishes them from different types of loans is that there’s no laborious inquiry involved, making it doable for individuals with bad credit scores, personal loans for bad credit monthly payments and even no credit score historical past in any respect, to get accredited for emergency funding.

Personal loans for bad credit are loans which might be particularly designed for folks who have a poor credit score history. Sure, you may qualify for a automotive loan in Ontario, even with less-than-perfect credit. And within the case of pawn store loans and automobile title loans, you threat shedding your property or car for those who don’t sustain with your payments. Like many bad credit loans, a no credit score check personal loan can carry increased interest charges and fees compared to conventional loans resulting from the chance the lender assumes by not checking credit score historical past. If you are a younger particular person like 25 or underneath and making an attempt to get a loan, chances are you'll have to get a cosigner. Brick-and-mortar stores for payday loans are frequent amongst people who choose face-to-face interactions or want to use for their payday loans in particular person. Nonetheless, lenders willing to take a danger on borrowers who have to get a loan with no credit are sometimes the same lenders who take a risk on borrowers with poor credit score. It is because lenders take a better threat by not conducting an official credit score verify when borrowers apply.

Reviews